While operating a business activity on the territory of a special economic zone, the entrepreneur granted the permit can count on income tax exemptions (Polish CIT or PIT depending on the form of a running business).

The amount of public aid is counted as a percentage of:

- costs related to the new investment

- cost related to creation of new jobs

As eligible costs that are allowed as associated to the new investment one can take:

- purchase of land or the perpetual usufruct right,

- purchase or creation by one’s self tangible assets under the condition that they will be incorporated to company’s assets,

- development or modernization of already owned tangible assets,

- obtaining intangible assets related to transfer of technology (patents, licences, know-how, not patented technical knowledge),

- costs related to rent or lease of lands, buildings and structures under the condition that the rent or lease lasts at least 5 years (large enterprise) or 3 years (SME) from planned date of finishing the new investment,

- financial leasing of assets other than lands, buildings and structures under the condition that they are bought once the day of rent or lease expires.

The entrepreneur is obliged to maintain the investment in the region for at least 5 years (large enterprise) or 3 years (SME). In addition all purchased assets must be maintained for 5/3 years from entering them into the records of tangible and intangible assets. The only exception is replacement of equipment due to fast technological development.

Fixed assets purchased by large enterprises must be new. Small and medium enterprises can buy second-hand fixed assets.

As expenses related to creating new jobs one should understand two-year-period costs of newly hired employees (after the permit is granted) in connection with the investment. The expenses cover gross costs of employment extended by compulsory social insurance contributions. In addition newly created jobs must be maintained for 5 years (large enterprise) or 3(SME).

Minimum value of an investment in a special economic zone is 100 thous. EUR according to NBP exchange rate published on the day that the permit was granted.

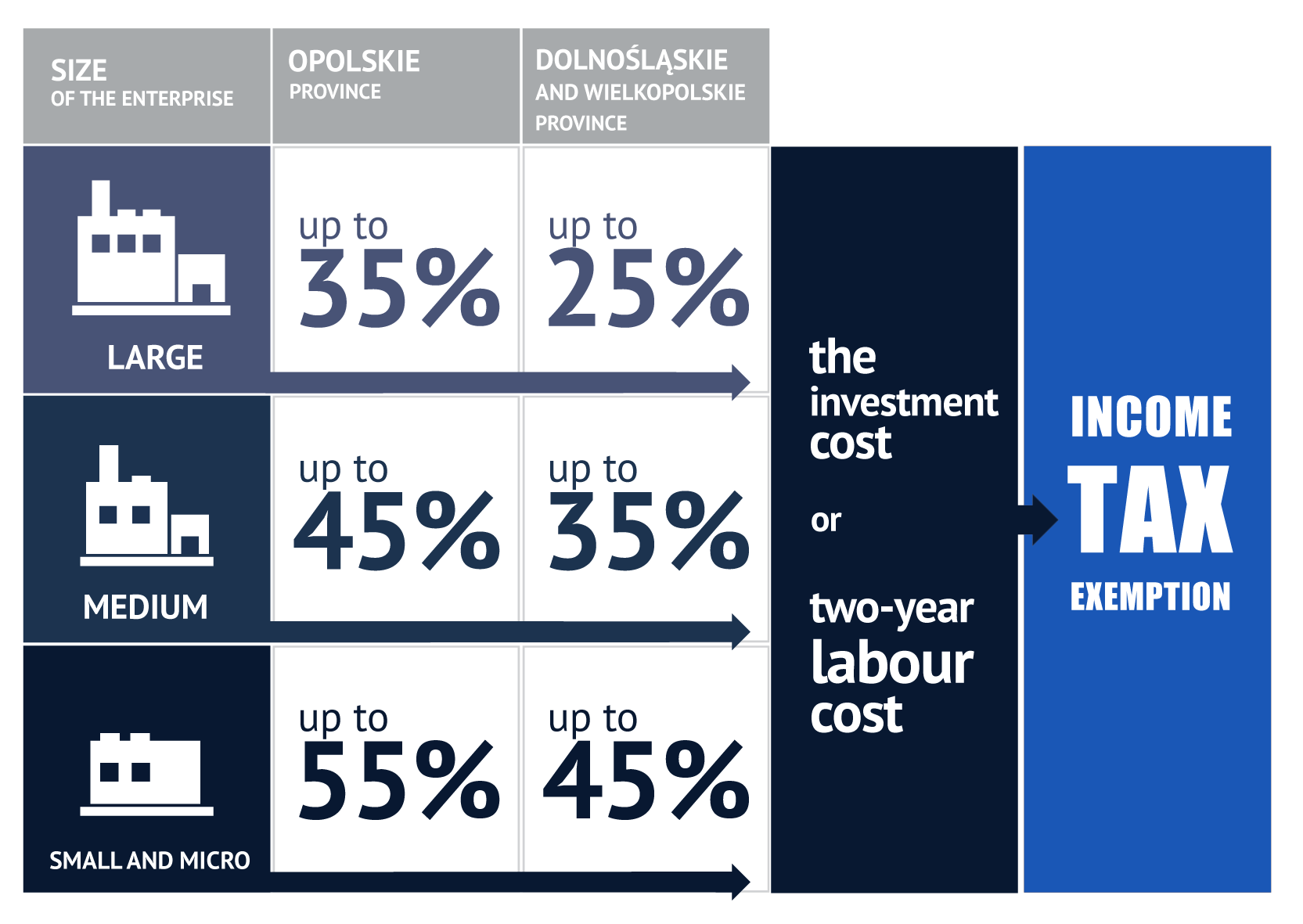

The status of an enterprise influences the amount of public aid. The smaller the enterprise, the bigger the percentage of provided aid can be.

| Size of enterprise | Lubuskie and Opolskie Province | Dolnośląskie and Wielkopolskie Province |

|---|---|---|

| large | up to 35% | up to 25% |

| medium | up to 45% | up to 35% |

| small and micro | up to 55% | up to 45% |

Description: the chart presents the level of regional public aid for provinces in which Wałbrzych Economic Zone operates.

In one investment project the entrepreneur can use different sources of public aid, not only the income tax exemption but amongst others also European donations, government grants, co-financing the creation of new jobs, real estate tax exemptions.

WSSE "INVEST-PARK". Wałbrzyska Specjalna Strefa Ekonomiczna "INVEST-PARK".

WSSE "INVEST-PARK". Wałbrzyska Specjalna Strefa Ekonomiczna "INVEST-PARK".